Category: Choosing a Probate Attorney in Oregon

Choosing a Probate Attorney in Oregon: A Comprehensive Guide

Introduction

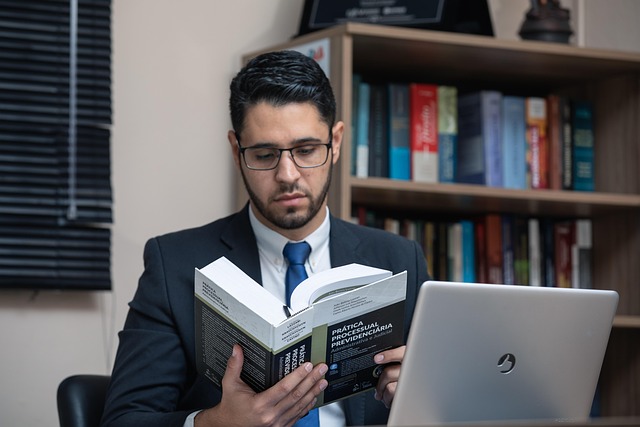

In the intricate world of estate planning and administration, the role of a probate attorney is pivotal, especially when navigating the legal complexities of Oregon’s probate laws. This comprehensive article delves into the process of selecting the right probate attorney in Oregon, empowering individuals and families to make informed decisions during what can be an emotionally charged and challenging time. By understanding the key considerations, trends, and challenges, readers will gain valuable insights to ensure they choose a qualified and suitable legal representative for their estate matters.

Understanding Choosing a Probate Attorney in Oregon

Definition: Choosing a probate attorney involves selecting a legal professional specialized in probate law, who will guide clients through the administration of an estate, ensuring compliance with Oregon’s legal requirements. This process includes managing assets, distributing property, and settling debts according to the deceased person’s wishes as outlined in their will or trust.

Core Components:

-

Estate Planning and Administration: Probate attorneys assist with preparing and executing estate planning documents, such as wills, trusts, and power of attorney. They also oversee the administration of the estate after a death, including filing necessary paperwork, managing assets, and distributing them according to legal directives.

-

Legal Expertise: These attorneys possess in-depth knowledge of Oregon’s probate codes, rules, and regulations. They are adept at interpreting complex laws, ensuring proper procedures are followed, and protecting the interests of clients and their estates.

-

Client Communication: Effective communication is vital. A good probate attorney should provide clear explanations of legal processes, listen to client concerns, and offer guidance tailored to individual needs. Regular updates and transparent conversations foster trust during what can be a stressful period.

Historical Context:

Oregon’s probate laws have evolved over time to balance the rights of individuals with the need for order in estate administration. Historically, probate was a lengthy process, often involving extensive court involvement. However, modern reforms have streamlined procedures, allowing for more efficient asset distribution while ensuring legal protection for all parties. The rise of advanced estate planning tools and trusts has also influenced the role of probate attorneys, enabling clients to take control of their assets and minimize legal intervention.

Global Impact and Trends

The choice of a probate attorney is not solely limited to Oregon; it reflects global trends and international influences in estate planning and administration. Here are some key factors:

-

Cross-Border Estates: With increasing global connectivity, many individuals have assets spread across different countries. This presents challenges for probate attorneys as they must navigate multiple jurisdictions with varying laws, tax implications, and cultural differences. International co-operation and expertise in cross-border estate planning are becoming increasingly vital.

-

Estate Planning Trends: Global trends include a growing emphasis on asset protection, tax efficiency, and family wealth preservation. Advanced estate planning techniques, such as offshore trusts and structured settlements, are being utilized to mitigate tax burdens and protect assets from legal claims. Probate attorneys must stay abreast of these developments to offer tailored solutions.

-

Digital Estate Planning: The digital age has brought about innovations in estate planning, including online wills, blockchain technology for asset management, and virtual meetings with attorneys. These trends are expected to continue shaping the probate landscape, offering greater accessibility and efficiency but also raising new privacy and security concerns.

Economic Considerations

The economic aspect of choosing a probate attorney involves understanding market dynamics and the potential impact on clients’ financial resources:

-

Market Dynamics: Oregon’s legal services market is competitive, with various law firms and independent attorneys offering probate services. Market research reveals that fees can vary significantly based on factors like an attorney’s experience, location, and the complexity of the estate. Clients should compare rates and services to find a cost-effective solution without compromising quality.

-

Investment Patterns: Estate planning is often seen as an investment in financial security and peace of mind. Some clients are willing to spend more for specialized legal expertise, especially when dealing with substantial estates or complex asset structures. Understanding the client’s financial situation and goals is crucial when determining the appropriate level of service and pricing.

-

Economic Impact: The choice of a probate attorney can have economic implications for both clients and the broader community. Efficient estate administration through competent legal representation can reduce costs, speed up asset distribution, and minimize potential disputes, ultimately benefiting all involved parties.

Technological Advancements

Technology plays a significant role in modern probate practices, enhancing efficiency and accessibility:

-

Online Legal Services: The rise of online legal platforms offers clients convenient access to probate attorneys and basic legal services. These platforms provide initial consultations, document preparation, and guidance at competitive rates. However, complex matters often require face-to-face interactions and specialized knowledge, making traditional law firms the preferred choice for many.

-

Case Management Software: Probate attorneys are adopting case management systems to streamline estate administration. These tools enable efficient tracking of documents, deadlines, and communications, improving client service and reducing administrative burdens.

-

Blockchain Technology: Blockchain has potential applications in probate, particularly in securing and verifying digital assets. Smart contracts could automate certain aspects of estate distribution, enhancing security and reducing costs. However, widespread adoption awaits further development and regulatory clarity.

-

Virtual Meetings and Remote Services: The COVID-19 pandemic accelerated the use of virtual meetings for client consultations and court appearances. This trend is expected to continue, offering flexibility and accessibility while maintaining face-to-face interactions where necessary.

Policy and Regulation

Oregon’s legal framework provides a solid foundation for probate practices, but understanding relevant policies and regulations is essential:

-

Oregon Probate Code: The Oregon Probate Code governs various aspects of estate administration, including will validation, asset distribution, and trust management. Attorneys must ensure compliance with these laws to protect client interests and avoid legal challenges.

-

Tax Implications: Estate tax regulations significantly impact probate proceedings. Attorneys must be knowledgeable about federal and state inheritance taxes, gift taxes, and exemption limits to minimize tax burdens for clients.

-

Regulatory Changes: Legal reforms and updates are common, requiring attorneys to stay current with changes in probate laws and regulations. These modifications may address issues like estate planning trends, asset protection strategies, or administrative efficiencies.

-

Ethical Considerations: Oregon’s Rules of Professional Conduct govern the ethical conduct of attorneys, including probate practitioners. Adherence to these rules ensures client confidentiality, avoids conflicts of interest, and maintains public trust in the legal profession.

Challenges and Criticisms

The probate process and attorney selection are not without challenges and criticisms:

-

Complexity and Cost: Probate can be a complex and lengthy process, especially for large estates or contested matters. This complexity often translates to higher legal fees, which can deter individuals from seeking professional help. Simplifying processes and offering transparent pricing structures can address these concerns.

-

Lack of Standardization: Different attorneys have varying approaches to probate, leading to inconsistencies in service quality. Some critics argue for more standardized procedures to ensure fairness and reduce potential disputes.

-

Conflicting Interests: Probate attorneys must balance the interests of multiple parties, including beneficiaries, creditors, and the estate itself. Conflicts of interest can arise, requiring strict ethical oversight and transparent communication.

-

Public Perception: Negative perceptions of the legal profession may deter individuals from hiring attorneys for probate matters. Building trust through transparent practices, educational resources, and client testimonials can counter these misconceptions.

Actionable Solutions:

-

Client Education: Providing accessible information about probate processes empowers individuals to make informed decisions and engage with attorneys on a more equal footing.

-

Standardized Forms and Procedures: Developing standardized forms and guidelines for common probate matters could reduce complexity and associated costs, making estate administration more efficient.

-

Ethical Training: Continuous education on ethical practices ensures attorneys remain vigilant against conflicts of interest and maintain client confidentiality.

-

Transparency in Pricing: Offering clear fee structures, including fixed fees for specific services, helps clients budget and reduces potential surprises.

Case Studies

Real-world examples illustrate the successful application of probate attorney services:

Case Study 1: Complex Estate with International Assets

Client Profile: A retired business executive with substantial assets in Oregon and abroad. The client had a complex estate structure, including foreign bank accounts and investments.

Challenges: Navigating international probate laws and tax implications was the primary challenge. Ensuring compliance with multiple jurisdictions’ regulations while minimizing tax burdens required specialized knowledge.

Solution: A seasoned probate attorney with experience in cross-border estates was engaged. They provided comprehensive guidance, assisting with:

- International estate planning strategies to optimize asset protection and taxation.

- Preparation of documents for foreign authorities, ensuring compliance with different legal systems.

- Efficient distribution of assets across jurisdictions, minimizing delays and costs.

Case Study 2: Dispute Resolution in Probate

Scenario: A sibling dispute over the distribution of a parent’s estate, involving real property and significant cash assets.

Solution: The probate attorney played a pivotal role in mediating the conflict between siblings. They facilitated open communication, provided legal insights, and helped negotiate a fair settlement agreement without the need for costly litigation. This approach saved the family substantial legal fees and preserved their relationship.

Future Prospects

The field of probate law is poised for growth and evolution:

-

Growing Elderly Population: Oregon’s aging population increases the demand for probate services, particularly as older individuals become more reliant on estate planning tools to secure their financial futures.

-

Technological Advancements: The integration of technology will continue shaping probate practices. Blockchain and digital asset management may become mainstream, revolutionizing estate administration.

-

Estate Planning Trends: Advanced planning techniques, such as dynamic trusts and wealth transfer strategies, are expected to gain popularity. These tools offer greater flexibility and control over asset distribution, appealing to clients with complex financial situations.

-

Specialized Services: As estates become more intricate, there will be an increased need for specialized probate services, including international estate planning, complex trust administration, and tax-efficient asset distribution.

Conclusion

Choosing a probate attorney in Oregon is a critical decision that impacts the efficient and equitable administration of estates. By understanding the core components, global trends, economic considerations, technological advancements, policies, challenges, and case studies, individuals can make informed choices. The future prospects for probate law in Oregon look promising, with technology and evolving estate planning trends shaping the legal landscape. As the state’s population continues to age, the demand for skilled probate attorneys will only grow, ensuring that this essential service remains accessible and effective.

FAQ Section

Q: How do I know if I need a probate attorney?

A: You may require a probate attorney if your estate is substantial, involves complex assets or foreign jurisdictions, or there are potential disputes among beneficiaries. Even for smaller estates, legal guidance can ensure compliance with Oregon’s probate laws and streamline the administration process.

Q: What questions should I ask when interviewing probate attorneys?

A: When selecting an attorney, consider these key questions:

- “What is your experience with similar cases?”

- “How do you handle client communication during the probate process?”

- “Can you provide references or testimonials from previous clients?”

- “What are your fees and what services are included?”

- “Are you up-to-date with the latest legal developments in probate?”

Q: Is it possible to use a probate attorney for simple estate matters?

A: Absolutely. While complex estates may require specialized attention, many basic probate matters can be handled by attorneys with general practice areas. For straightforward wills and small estates, online services or local law firms offering affordable rates can be suitable options.

Q: How can technology improve the probate process?

A: Technology offers numerous benefits, including efficient document management, secure digital asset transfer, and remote client communication. Online legal platforms provide initial estate planning tools, while advanced systems like blockchain could automate certain administrative tasks, reducing costs and increasing security.

Selecting Oregon Probate Attorney: Simple Guide to Expert Representation

Selecting an Oregon probate attorney involves understanding state laws, choosing a specialist with e…….

Navigating Oregon Probate: Choose Your Lawyer Wisely

Understanding Oregon probate laws is crucial for estate administration. Choosing the right Oregon pr…….

Navigating Oregon Probate: Find Your Trusted Attorney Tips

Understanding probate law is crucial for effective estate planning and administration in Oregon. Cho…….

Finding the Best Probate Attorney in Oregon for Estate Planning

Navigating Oregon Probate: Find Top-Rated Best Attorney

Hiring Probate Attorney Oregon: Smooth Process Ensure

Hiring a probate attorney in Oregon is vital for navigating complex estate administration. Their exp…….

Best Probate Attorney Oregon: Choosing Legal Expertise for Peace of Mind

Choosing the best probate attorney Oregon involves hiring a qualified professional with deep knowled…….

Find Oregon Probate Lawyer: Your Comprehensive Hiring Guide

Selecting Oregon Probate Attorney for Seamless Estate Handling

Choosing an Oregon probate attorney is crucial for navigating complex state laws and ensuring a smoo…….